Hi Phakamani Friends,

I hope this finds you in good health. It’s been a busy quarter with two visits from the Phakamani US team, a project to review Risk Management sponsored by one of our European funders, a project to review our Social and Environmental Performance (still underway) and sponsored by our other European funder, and a Grading & Benchmarking project sponsored by a local funder. We celebrated our 15th year of operation in April during one of the US visits and will continue celebrations with our staff at the annual Founders’ Lunch later this year.

The socio-economic conditions have not improved, and South Africa remains plagued with ongoing power outages which have had a more significant impact on all businesses than the covid pandemic. Despite the robust and relatively agile nature of our clients, the sector is vulnerable, and the economic impact is being felt. We are looking for ways to best serve our clients’ needs at this time and pray that they will find opportunities to continue their businesses and/ or find alternative business options that meet their customers’ needs.

We remain grateful for the ongoing success stories we do get to hear, where existing clients have expanded their homes, put children through school/ university, and generally improved their standard of living, and of new clients that join Phakamani, start a small business and begin to improve their lives.

June is our year end and early indications are that we will report a deficit, after grants, donations, and distributions, for the first time in several years. We had forecast this at the half-year mark and are at advanced stages of discussions with funders for additional grant funding. We are cautiously optimistic that we can raise the funding required.

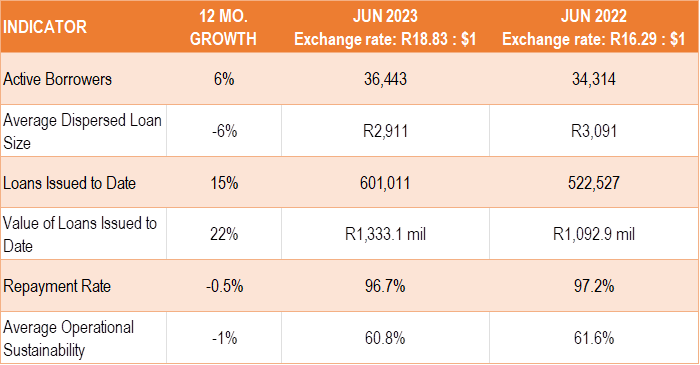

At year end we showed a 3.7% reduction in active clients while our loan book was at the same level as June 2022. New group development showed a growth of 15% in the last quarter which is encouraging. We have identified bank charges as a significant detractor for our clients and have initiated discussions with our banking partners to review ways to service this market more reasonably.

We will not open additional new branches in this financial year as we consolidate existing operations to better serve our clients and to improve productivities. While the economic conditions are relatively tough currently, like elsewhere in the world, we are committed to providing opportunity to those who are prepared to help themselves to succeed at micro-enterprise.

We recently upgraded our original entry-level tablets to meet the requirements for digitisation. This resulted in 188 entry-level tablets being returned to our IT Department over the past few months. We have donated these tablets to four very deserving non-profit organisations that provide educational resources to children through centres in the communities we serve.

God bless,

Eric